S&P 500 Breaks Record For A Second Week

Published Friday, August 28, 2020, 8:25 PM EST

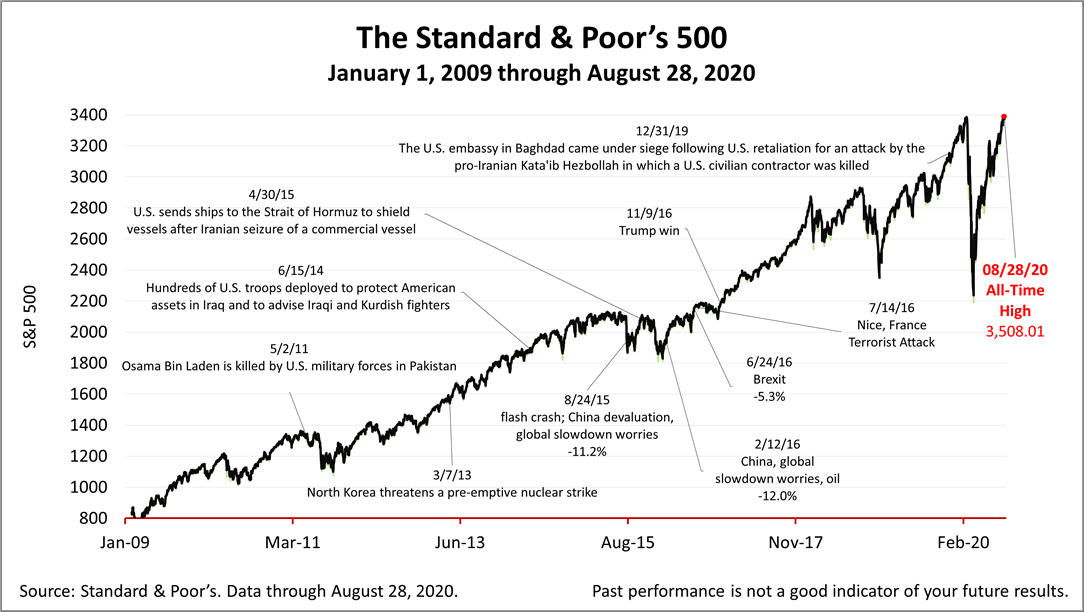

The Standard & Poor's 500 (S&P 500) stock index closed Friday at a new all-time high for the second week in a row, as the two worlds of the S&P 500 and the real economy grew further apart.

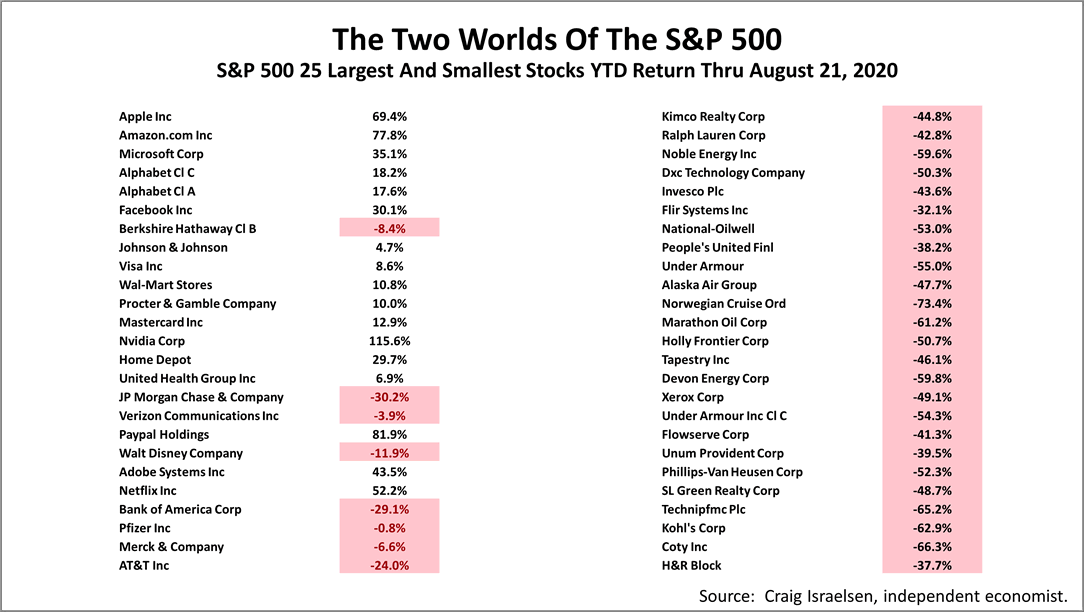

FAANGM -- Facebook, Amazon, Apple, Netflix, Google, and Microsoft -- led the recovery, the rest of the economy was on another planet.

According to Craig Israelsen, Ph.D., who teaches portfolio design to financial professionals, the largest 25 stocks in the S&P 500 represented 42% of the cap-weighting of S&P 500 index, as of August 21, 2020; the smallest 25 companies in the S&P 500 represented 0.3% of the performance of the index. The terrible losses year-to-date on the smallest 25 stocks are not influential in the market-cap weighted S&P 500 index, but they reflect the world of pain in the real economy.

Of the 500 stocks in the S&P 500, 294 had a negative return through last Friday, Israelsen said. The average loss year-to-date return of the 294 companies was -24.1%.

The S&P 500 stock index closed Friday at 3,508.01, a new all-time high, surging +3.21% from last Friday. It's +44.23% higher than its March 23rd bear market low.

As the S&P 500 breaks records, it's prudent to remember that the S&P 500 is not the real economy. The disconnect between the market-cap weighted S&P 500 and the broader economy is one of many anomalies caused by the Covid shutdown and recovery.

The bottom line is that the FAANGM stocks are not trading at outlandish valuation levels, not even close to the 1999 tech-bubble. At the same time, the performance of the S&P 500 is not reflecting the broad economy's pain. The two things are both true as the economic recovery from the pandemic, haltingly, has progressed.

Stock prices have swung wildly since the crisis started in March and volatility is to be expected in the months ahead.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial situation, or particular needs. Product suitability must be independently determined for each individual investor.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Preferred NY Financial Group,LLC and is not intended as legal or investment advice.

An individual retirement account (IRA) allows individuals to direct pretax incom, up to specific annual limits, toward retirements that can grow tax-deferred (no capital gains or dividend income is taxed). Individual taxpayers are allowed to contribute 100% of compensation up to a specified maximum dollar amount to their Tranditional IRA. Contributions to the Tranditional IRA may be tax-deductible depending on the taxpayer's income, tax-filling status and other factors. Taxed must be paid upon withdrawal of any deducted contributions plus earnings and on the earnings from your non-deducted contributions. Prior to age 59%, distributions may be taken for certain reasons without incurring a 10 percent penalty on earnings. None of the information in this document should be considered tax or legal advice. Please consult with your legal or tax advisor for more information concerning your individual situation.

Contributions to a Roth IRA are not tax deductible and these is no mandatory distribution age. All earnings and principal are tax free if rules and regulations are followed. Eligibility for a Roth account depends on income. Principal contributions can be withdrawn any time without penalty (subject to some minimal conditions).

©2020 Advisor Products Inc. All Rights Reserved.